Trane Technologies (TT)·Q4 2025 Earnings Summary

Trane Technologies Beats Q4 as Applied HVAC Bookings Surge 120%; Record Backlog Hits $7.8B

January 29, 2026 · by Fintool AI Agent

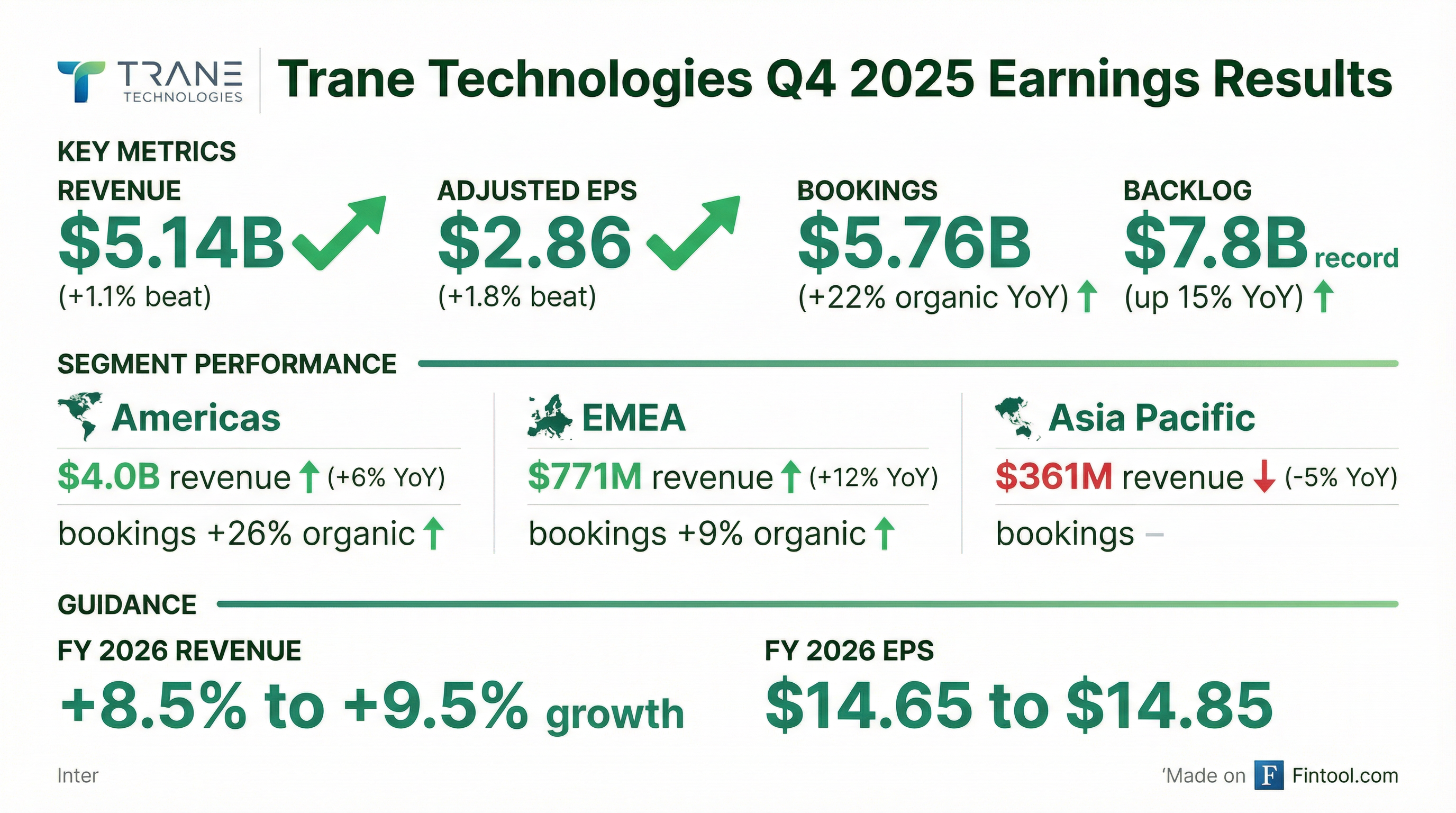

Trane Technologies (NYSE: TT) delivered another strong quarter, beating both revenue and earnings estimates while posting record bookings that signal robust demand heading into 2026. The climate solutions company reported Q4 2025 adjusted EPS of $2.86, topping consensus of $2.81 by 1.8%, marking the company's eighth consecutive quarterly earnings beat.

The standout metric: Americas applied equipment bookings surged 120% year-over-year, driving book-to-bill of 200% in the applied segment.

Did Trane Technologies Beat Earnings?

The revenue beat was driven by continued strength in Commercial HVAC, though residential and transport refrigeration markets remained "challenging." Adjusted operating margin held flat year-over-year at 16.3%, with strong volume and positive price realization offsetting inflation.

What Changed From Last Quarter?

The big story is the acceleration in bookings momentum, particularly in Americas Commercial HVAC:

Record backlog of $7.8 billion provides exceptional visibility into 2026, up 15% versus year-end 2024. Americas Commercial HVAC backlog alone is up 25%, while EMEA Commercial HVAC backlog surged 40%.

CEO Dave Regnery highlighted the structural tailwinds: "We continue to see tremendous strength and rapidly growing pipelines in our commercial HVAC businesses, led by the Americas, where fourth quarter applied bookings were up more than 120%."

How Did Each Segment Perform?

Americas (78% of Revenue)

The Americas drove the quarter with Commercial HVAC bookings up 35%+ and applied equipment bookings up over 120%. Book-to-bill in applied reached 200%, signaling strong future revenue. Operating margin compressed 40 bps on mix and continued business reinvestment.

EMEA (15% of Revenue)

EMEA benefited from ~8 percentage points of positive FX and 2 points from acquisitions. Commercial HVAC backlog is up ~40% versus year-end 2024, suggesting strong 2026 performance in the region. Margin compression reflects mix and investment.

Asia Pacific (7% of Revenue)

Asia Pacific remains a soft spot with organic revenue down 6%, but the segment delivered the highest operating margins in the company at 25.7%.

What Did Management Guide?

Q1 2026 Outlook

Guidance takeaways:

- Revenue guidance above consensus: 8.5-9.5% growth implies ~$23.1-23.3B vs. Street at ~$22.9B

- EPS guidance roughly in-line: Midpoint of $14.75 vs. consensus $14.79

- Visibility is exceptional: Record $7.8B backlog de-risks the top-line outlook

- Q1 expected soft: Flattish organic revenue with ramp through year as residential improves in 2H

2026 Modeling Assumptions

How Did the Stock React?

The stock closed at $394.20 on January 28, up 0.5% heading into earnings. In after-hours trading, shares rose to $398.99, up approximately 1.2% on the results.

52-week range: $298.15 - $476.19

Since launching as Trane Technologies in 2020, the company has delivered impressive returns, with Regnery noting: "Since launching Trane Technologies in 2020, we've built a powerful long-term track record – including compound annual revenue growth of 11%, EBITDA margin expansion of 470 basis points, compound annual adjusted earnings per share growth of 24%, and free cash flow conversion of 106%."

Full-Year 2025 Summary

Capital Allocation

For full-year 2025, Trane Technologies deployed or committed $3.2 billion in capital:

- Dividends: ~$840 million

- Share repurchases:

$1.5 billion ($4.7B remaining under authorization) - M&A/Investments: ~$720 million

- Debt retirement: ~$150 million

For 2026, management expects to deploy $2.8B to $3.3B, with a significant increase in M&A activity:

Stellar Energy Acquisition

Trane announced the acquisition of Stellar Energy, expected to close in Q1 2026:

- Price: ~$550M, or

13X 2025 EBITDA ($40M) - Revenue: ~$350M

- Strategic Rationale: Expands capabilities in high-growth data center market

- Modular design reduces risk and speeds time-to-market for data centers

- Expected accretion: ~$0.03 EPS in year one (post acquisition and integration costs)

Balance Sheet Strength

The company earned an S&P rating upgrade from BBB+ to A- in December 2025, reflecting strong financial position. The dividend has increased 77% since the launch of Trane Technologies in March 2020, with the 2025 annual rate at $3.76 per share.

Management reiterated their capital allocation philosophy: "The Company expects to continue to pay a competitive and growing dividend and to deploy 100 percent of excess cash to shareholders over time."

Market Outlook by Segment

Residential HVAC

Management provided a prudent outlook for residential: flat to modestly lower (0 to -5%) revenue in 2026. Channel inventory is largely normalized, paving the way for healthier markets. Expect challenging 1H on tough comps, pivoting to tailwinds in 2H on easier prior-year comps and improving fundamentals.

Transport Refrigeration

ACT forecasts 2026 N.A. trailer market down ~7% YoY to ~23.3K units, with recovery beginning late 2026. Key fundamentals improving:

- Age of fleet oldest in 25 years

- Spot vs. contract rates tightening

- ACT expects >50% growth in 2027 and >35% in 2028

Management noted: "We have maintained high levels of investment in innovation throughout downcycle and are well positioned to drive outperformance as markets recover."

Key Risks and Considerations

- Residential market headwinds: Expect trough in 1H with 0 to -5% full-year revenue outlook

- Transport refrigeration soft through 1H: ACT forecasts market down ~7% in 2026 before recovery

- Asia Pacific weakness: China continues to be challenging with dynamic macro conditions

- Year-one M&A costs: Reported leverage ~700 bps lower than organic due to acquisition integration costs

- Backlog concentration: Strong performance heavily dependent on Americas Commercial HVAC conversion

- Macro risks: Company flagged tariffs, inflation, and geopolitical conflict

Q&A Highlights: What Analysts Asked

Revenue Trajectory for 2026

CFO Chris Kuhn provided granular guidance for Americas Commercial HVAC revenue progression:

"Think about Applied Solutions, not uncommon to think about a 9-month cycle from order date to ship date." — Chris Kuhn

Vertical Breadth: Not Just Data Centers

When asked if the bookings surge was narrowing to data centers, CEO Dave Regnery emphasized broad-based strength:

"Data centers are very strong... But I would also tell you that if you look across the 14 verticals that we track, at least in the Americas, we had broad-based growth... I think we had 12 of 14 verticals up."

Notably, retail and office are recovering — verticals that were previously weak. Pipelines remain "very robust" and at record levels as the company enters Q1.

Data Center Deep-Dive: The NVIDIA Question

Multiple analysts pressed management on implications of recent NVIDIA commentary about thermal management evolution. Key takeaways:

Working directly with hyperscalers and chip makers: "We're working very closely with many influencers in the data center vertical. So think of hyperscalers, think of chip manufacturers like NVIDIA and others... We're helping them design data centers of the future, or you may have heard them referred to as reference designed data centers." — Dave Regnery

Chillers remain essential: "I have not seen a reference design or data center of the future that does not include chillers, just to be very clear." — Dave Regnery

On runtime concerns: "Chillers are mechanical systems. They're not a lot different than maybe your car. So you don't leave your car in the garage for six months and don't run it, because if you did, you may not be very happy when you go out to try to start it up. So these systems do need to run at some point." — Dave Regnery

HVAC content per data center — expected to stay roughly the same, though power consumption by thermal systems may decrease, allowing more compute capacity.

Service tail in data centers — may be "a bit lower" than the typical 8-10x equipment cost due to potentially shorter refresh cycles as efficiency improves. Still modeling this.

Service attachment rates — dramatically higher than a decade ago: "I'd be hard-pressed to think where we've done a major chiller farm where we haven't had the service agreements."

Residential: Intentional Inventory Reset

Management was very clear that the Q4 deleverage was intentional:

"We were very, very intentional in the fourth quarter to get the inventory right... we took a third of the production days out. So we knew that was gonna cost us on the bottom line as we deleveraged over 60% in that particular business." — Dave Regnery

Q1 2026 resi outlook: Down ~20% on high-teens comps from Q1 2025. Deleverage expected to be better than Q4 with level-loaded production assumptions.

Pricing: Management pushed back on discounting concerns — "We've not seen pricing fade in the business." Later clarified: "I don't want anyone to think that pricing is coming down."

Price/Cost and Tariff Dynamics

CFO Chris Kuhn provided detail on inflation management:

"We have a very proven and strong track record of staying ahead of inflation... confident that 1.5 points of price would be in a position to drive the 20-30 basis points of margin growth." — Chris Kuhn

Commodity exposure: Tier 1 raws ~$750M, Tier 2 ~$5.5-6B.

Segment Incrementals and Margin Outlook

All three segments targeting 25%+ organic leverage in 2026. Reported incrementals will be ~700 bps lower due to year-one M&A dilution.

Other Notable Q&A Points

Commercial unitary: Expected flattish in 2026, with applied carrying the growth.

Capacity: Chiller capacity up 4x over last 2-3 years through factory optimization, supply chain partnerships, and service technician additions (7,500+ globally).

EMEA data centers: Currently about 1/10th the size of US facilities, though larger facilities may be coming. Similar dynamics in Asia.

Biopharma reshoring: In the pipeline but not yet converting to orders — one of 2 verticals that were down in Q4. Management is "hopeful" for near-term conversion.

Backlog visibility: Over $1 billion of backlog is for 2027 and beyond, up more than 30% versus a year ago.

The Bottom Line

Trane Technologies delivered another clean quarter with its eighth consecutive EPS beat. The standout is the explosive bookings growth in Americas Commercial HVAC, where applied equipment orders more than doubled. With record backlog providing strong visibility and guidance implying continued double-digit EPS growth, the demand environment appears robust.

The earnings call provided important context: demand is broad-based (12 of 14 verticals growing), data center concerns are overblown (chillers remain essential in future designs), and management is confident in pricing power despite macro uncertainty.

The key debate: Can the company sustain this bookings momentum, or is this a pull-forward from 2026/2027 demand? At ~27x forward earnings, the stock is pricing in continued execution.

Sources: Trane Technologies Q4 2025 Earnings Release (8-K), Q4 2025 Earnings Call Transcript, S&P Global consensus estimates